Credit Unions... Financial Cooperatives Working for Your Best Interest

by Linda Andry, President and CEO, Ascentra Credit Union

When Alcoa Employees Credit Union was formed in 1950, they had one thing in mind: to help and protect each other.

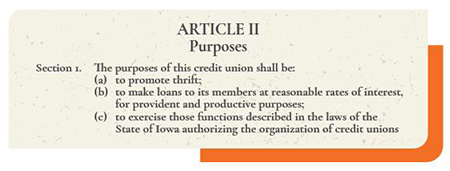

I looked back at our initial by-laws (circa 1950) and in Article II, it defined our purpose, which was “to promote thrift, to make loans at a reasonable rate of interest and to exercise those functions within the laws of the State of Iowa.”

Today, Ascentra continues to exercise those same purposes and powers, encouraging habits of thrift and creating a source of credit at a “fair and reasonable rate of interest.” If we dive into the definition of thrift, sources indicate that thrift is defined as "the quality of using money carefully and not wastefully." As a member-owner of Ascentra, it is our duty to educate and inform you that there are predatory lenders who DO NOT have your best financial interests in mind and will divert your ability to use YOUR money for their own benefit.

Predatory lending is any lending practice that imposes unfair and abusive loan terms on borrowers. On the surface, these businesses may seem like they are helpful and may be meeting an immediate financial need for a consumer, but as you peel back the layers, the cost of doing business with these predatory lenders are a detriment to consumers’ financial well-being.

We did some research on rent-to-own business models, and I want to share the following example with you:

A 43-inch Samsung UHD 4K Smart TV has a price of $278 at your local retail store, but the "buy-it-now" price at a rent-to-own store is marked up to $485.99. From the start, the cash price of the TV is 74 percent higher at the rent-to-own store. So, what happens if a consumer doesn't have cash to pay the buy-it-now price? Well, you can rent-to-own at $53.99 per month for 18 months, totaling $971.82. The $485.99 TV purchased from the rent-to-own store now costs the consumer $971.82, more than double the already over-priced buy-it-now cost! This is not an example of thrift or using money carefully.

We realize that not everyone has cash on hand to make a larger purchase, but there are more cost-effective ways to secure that desired TV. At Ascentra, we offer reasonable and fair rates of interest on credit cards and unsecured loans, because we know that is in the best interest of our membership. With an Ascentra Visa® credit card, even at our highest rate of interest of 17.88%, the $278 TV at the local retail store would cost a consumer $292.54 if paid off within 6 months at $48.76 per month.

- Rent-to-own = $53.99 per month for 18 months; $485.83 of interest

- Ascentra Visa® credit card = $48.76 per month for 6 months; $14.54 of interest

If buy-it-now with cash isn't an option for you, would you rather pay $971.82 for a $278 TV, or $292.54 for that TV? Predatory lenders focus on whether the consumer can afford the monthly payment, not the entire cost of the purchase. Our lending team at Ascentra works diligently to offer our members fair and reasonable rates of interest, based on their individual situation.

I urge you to consider Ascentra for all your lending needs to protect your financial health and promote thrift within your budgets. We are here for you, as your trusted financial cooperative, for the past 74 years, and for decades to come!

Thank you for being a member of Ascentra Credit Union!