CashNOW Loans

A Short-Term Loan with a Conscience

You have your reasons. You have them now. With Ascentra's CashNOW, we have your how.

Things come up. We get it. Sometimes, you have the cash to make them go away and sometimes, you don't. At those times when you need cash and you need it quickly, finding a reliable lender who isn't going to take advantage of you can be overwhelming. Ascentra's CashNOW is the light at the end of your tunnel.

CashNOW is our no-credit-check solution to getting you cash quickly. Apply and get approved in just minutes - with cash deposited immediately.

Perks

- No credit checks

- Simple. Fast. Available 24/7

- 60 seconds to get approval

- Cash available immediately

- Short-term loan up to $2,000

- Helps build good credit

*Must be a member for 90 days with approval based on deposit history.

Qualifications

- Must be at least 18 years old

- Member for at least 90 days

- Must apply in Digital Banking

Payment Options

Your first payment on your CashNOW loan must be between 30 - 45 days after loan approval.

The application will prompt you to select your first payment date based on this criteria and will guide you to select a monthly recurring payment date for auto-withdrawal from the account of your choosing.

CashNOW Loans

When your wallet is feeling a little light, you want Ascentra in your back pocket to feel confident in your finances. Whether it's an auto repair, a pet emergency or even a concert ticket, Ascentra's CashNOW loans offer up to $2,000 for you to make the best decision for YOU.

CashNOW loans are for $300 - $2,000 at 21% APR* and qualify for the following repayment terms:

- $300 - $1,000 | 12 months

- $1,000.01 - $1,500 | 18 months

- $1,500.01 - $2,000 | 24 months

*APR = Annual Percentage Rate.

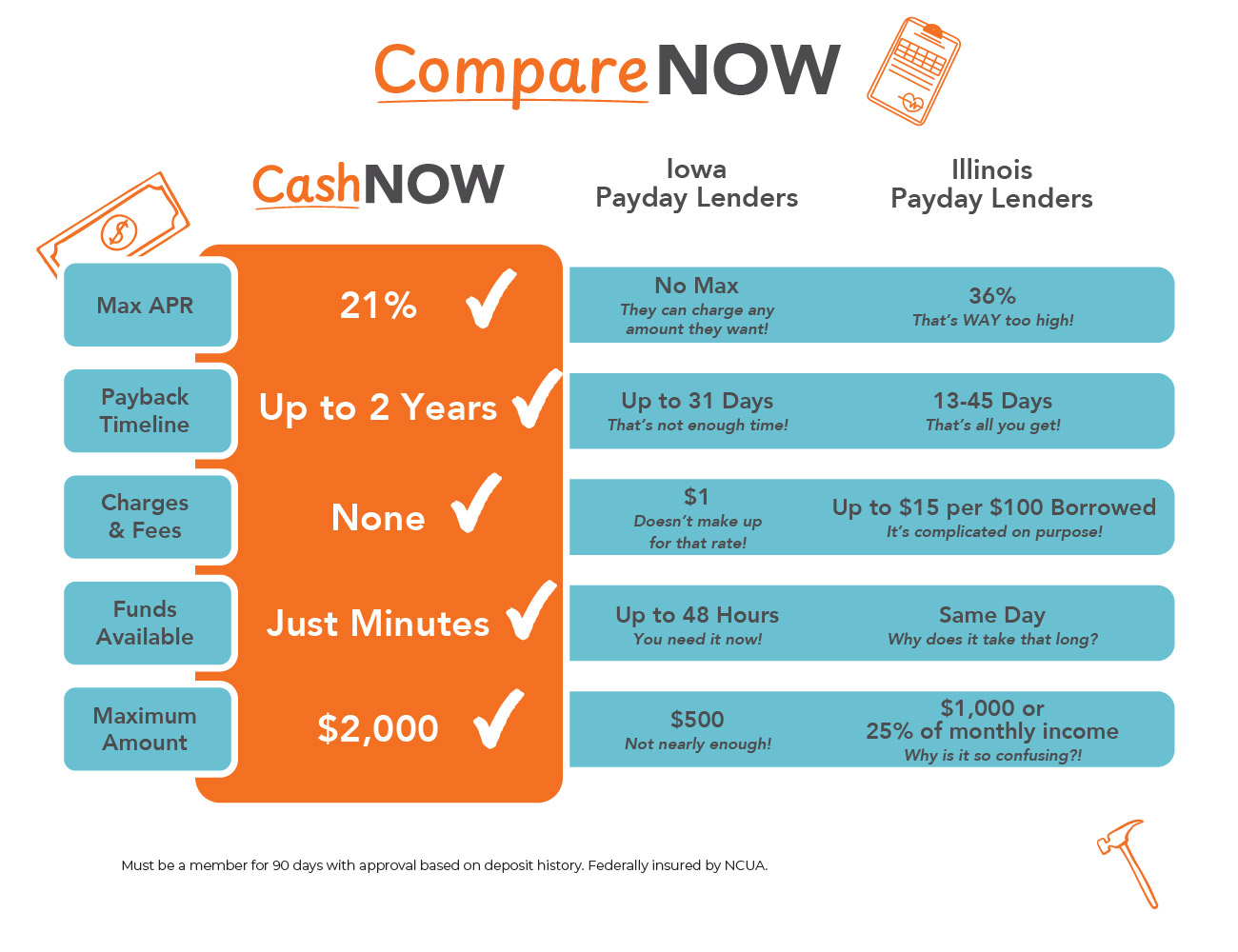

A Smarter Alternative to Payday Loans

When life happens and you need cash, convenience is king - and payday lenders can be pretty convenient. But convenience doesn't always pay. Sometimes, convenience can even cost you big time.

Let's break down an example.

If you go to a payday lender in Iowa for a $500 loan, they can charge you up to $55 in application and origination fees.

In Iowa in 2020, the average cost for borrowing $500 from a payday lender was $440 in fees, finance charges and interest. That means a few weeks later, you'll owe that payday lender $940!

When you borrow $500 from Ascentra as a CashNOW loan, at 21% for 12 months, the interest for your loan will be $58.37. When all is said and done, you will pay back a total of $558.37. This means that you would save $381.63 by choosing Ascentra's CashNOW loan instead over a payday lender.

Plus, we give you longer to pay it off.

FAQs

General

-

Will this loan impact your credit?

A: Although there is no credit check when applying for a CashNOW loan, it will be reported to the credit reporting agencies and could affect your credit score. A CashNOW loan could be a great way to help you build credit.

-

How long does it take to get funds following the application process?

A: Upon approval, the funds are immediately deposited into the account you identify during the application process. You just need to make sure you fully complete the application.

-

How many CashNOW loans can be open at one time?

A: Two loans can be open at a time but cannot exceed a combined total of $2,000. No more than four loans can be opened in a rolling 12-month period.

-

Can CashNOW Loans be paid off early?

A: Yes, CashNOW loans may be paid off early through a fund transfer between accounts in Digital Banking (transfer payments on top of automatic payments), a branch visit or by contacting our Digital Branch at 563-355-0152 or through online chat at ascentra.org.

Payment

-

Are automated payments required?

A: Yes, automated payments are required but you will be able to select one of five days throughout the month for your payment. Those options are: 5th, 10th, 15th, 20th or 25th day of the month

-

When is the first payment made?

A: The first payment is not to exceed 45 days from the application approval. Your first payment will be disclosed when selecting your monthly payment date.

-

Who should I contact if I need to change my payment due date?

Payment due dates can be changed to any reoccurring monthly dates (excludes 29th, 30th and 31st) by visiting a branch or contacting a digital branch representative at (563) 355-0152 or through online chat at ascentra.org.

-

Do CashNOW loans qualify for Skip-a-pay?

A: No.

Applying

-

Who qualifies for a CashNOW loan?

A: A member must have 60 days of deposit history to qualify. This includes deposit types such as cash, checks, ACH and payroll deposits.

CashNOW will aggregate all the deposits on all the accounts that the primary member is on including possible joint owner’s deposits. It will not consider money transferred from another share on the same account as a deposit.

-

Who is eligible to apply for a CashNOW loan?

A: Anyone who has been a member for 90 days and is primary member on a consumer account* that is in good standing.

*Exclude all fiduciary and business accounts.

-

How can you apply for a CashNOW Loan?

A: It’s easy… you need to log in to Ascentra’s Digital Banking and click on the “CashNOW Apply Now” button below their account tiles. It takes 60 seconds to get approval and is available 24/7.

-

Is there a minimum age limit for a CashNOW loan?

A: The minimum age requirement is 18 years old.

Loan Specifics

-

What is the minimum loan amount?

A: The minimum loan amount for a CashNOW loan is $300.

-

What is the maximum loan amount?

A: The maximum loan amount for a CashNOW loan is $2,000.

NOTE: Not to exceed a cumulative unsecured loan limit of $10,000. (e.g. if you have an Ascentra credit card with a borrowing limit of $5,000 and a personal loan for $3.500, you have a cumulative borrowed amount of $8,500. In this example, only $1,500 would be available for a CashNOW loan. In the event you qualify for a loan amount that would result in your cumulative unsecured loan amount exceeding the $10,000 limit, your application for a CashNOW loan would be denied.)

-

What are the loan terms for a CashNOW loan?

A: The loan terms for a CashNOW loan are:

- $300 - $1,000 | 12 months

- $1,000.01 - $1,500 | 18 months

- $1,500.01 - $2,000 | 24 months

-

What are the fees and interest rate of a CashNOW loan?

A: No origination fees. No application fees. The rate for a CashNOW loan is 21%.

-

Ascentra Anywhere

Ascentra Anywhere allows you to do all your banking with the click of a button or tap of your finger. This includes our Mobile App, Pay Bills, Financial Tools, Digital Wallets, and Mobile Payments. It’s banking made easy, anywhere!

-

Ascentra Mobile App

Today’s world requires being able to manage your accounts on the go. Ascentra’s Mobile app gives you that and more by providing a simple way to apply for a loan or credit card from wherever you are, whenever you need to.

-

Personal Loans

Unsecured line of credit. Share-Secured loan. Personal/signature loan. They may have different names, but they all have one thing in common. These are financially safe and responsible ways to build or establish credit and can help keep you afloat until payday. Most importantly, they help you save some serious cash.

-

Fixed Rate Mortgage

10 & Done (10 Year Fixed)5.75View Mortgage Loans% -

Vehicle Loans

New & Used Auto as Low as5.25View Vehicle Loans% APR -

Savings

Membership Share Savings Starting at0.05View Savings Accounts% APY -

Credit Cards

No Balance Transfer Fee. 6-Mo. Intro Balance Transfer2.99View Credit Cards% APR